What you Need to Know about Pre-Approval

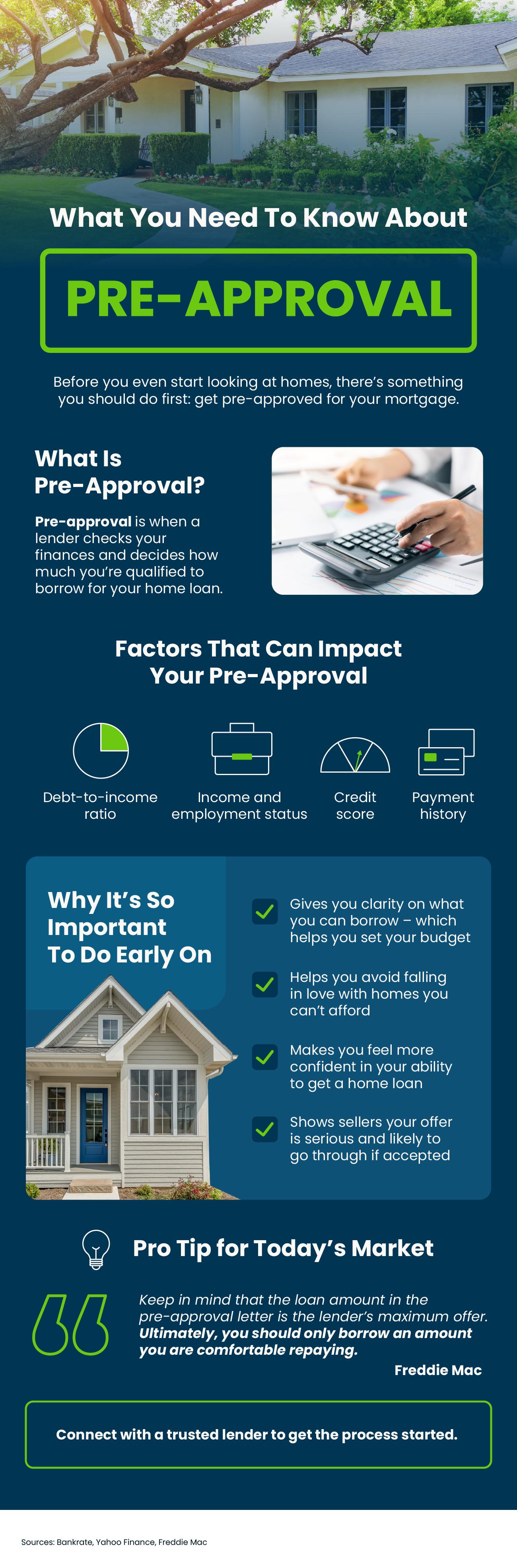

What You Need To Know About Pre-Approval

Some Highlights

- Before you even start looking at homes, there’s something you should do first – and that’s get pre-approved for your mortgage.

- Pre-approval is when a lender checks your finances and decides how much you’re qualified to borrow for your home loan. This helps you determine your budget and makes your offer stand out for sellers.

- Connect with a trusted lender to get the process started.

Categories

Recent Posts

Is Buyer Demand Picking Back Up? What Sellers Should Know.

United Realty Group Inc. & Larry Hering Realty: Your Local Real Estate Leaders in Weston, FL

This May Be the Best Time to Buy a Brand-New Home

More Homeowners are Giving up on their low Mortgage Rate

Would You Let $80 a Month Hold You Back from Buying a Home?

Why Your Home Equity Still Puts You Way Ahead

Why a Title Company Is All You Need to Close Your Real Estate Deal — No Attorney Required

100 Bright and Beautiful Kitchen Ideas

3 Reasons Affordability Is Showing Signs of Improvement This Fall

What Everybody should Know Abut White Quartz Countertops

Larry Hering

Realtor/Senior Account Executive | License ID: 3370040

+1(954) 258-4926 | lhering216@gmail.com